SERVICES

Investment and Portfolio Risk Management

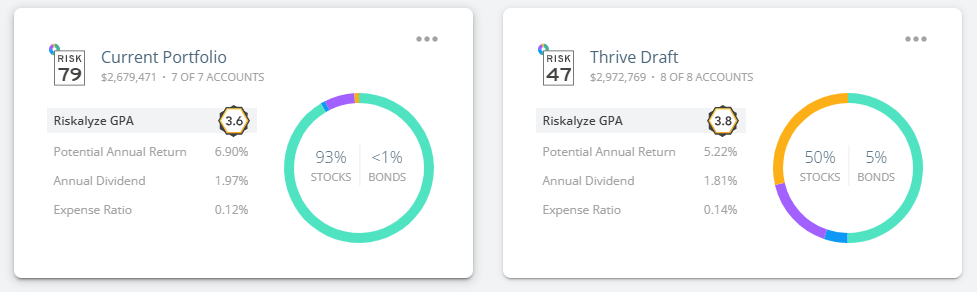

Our investment portfolios are carefully designed to help retirement investors reduce risk, improve returns, and create a reliable income stream.

Click Here to Find Your Risk Number

To secure your nest egg, we adhere to the following three fundamental principles:

1) MAINTAIN LOW COSTS

The cost of your investments is the strongest indicator of future profits. In other words, it is anticipated that low-cost investments will yield higher returns than high-cost ones.

We use extremely low-cost index funds to develop our retirement portfolios as a result. This lowers unnecessary risk while increasing the likelihood that your retirement plan will be successful.

2) TAX-EFFICIENT INVESTMENTS

Warren Buffett says his favorite holding period is forever. We agree.

We build portfolios with "low turnover," despite the fact that most retirees can't afford to buy an investment and hold it forever.

Costs are incurred each time an investment is bought, sold, or otherwise “turned over” — not only outright expenses like transaction fees and taxes, but also covert expenses like bid-ask spreads.

Your investment returns are reduced by these expenses. We focus on investments with low turnover in order to safeguard your investment returns and save taxes.

3) OWN THE APPROPRIATE ASSET CLASSES

Investments vary greatly from one another. It does not follow that you should invest your money in something just because you can (for example, gold).

We believe asset classes in which we invest:

- Have greater risk-adjusted returns, as demonstrated by academic research

- Work well when combined in a diverse portfolio (for example, they have low and/or negative correlation to one another)

For instance, amid catastrophic events, corporate bonds might behave like equities. That does not offer the diversification that an investor in retirement needs.

As fiduciaries, our job is to make investment decisions that are in your best interest. This means ignoring the daily headlines and sticking with evidence-based solutions.